Wall Street buys over $1B in Bitcoin amid dollar's ‘do or die’ moment

Cointelegraph

Jun 26, 2025 12:54:56

Key takeaways:

Wall Street poured over $1 billion into Bitcoin ETFs this week amid rising bets on Fed rate cuts and a weakening US dollar.

Trump’s early Fed replacement plans intensified dollar selloffs, pushing DXY to its lowest since April 2022.

Analysts warn July could trigger a major dollar breakdown, fueling Bitcoin’s rise toward new highs.

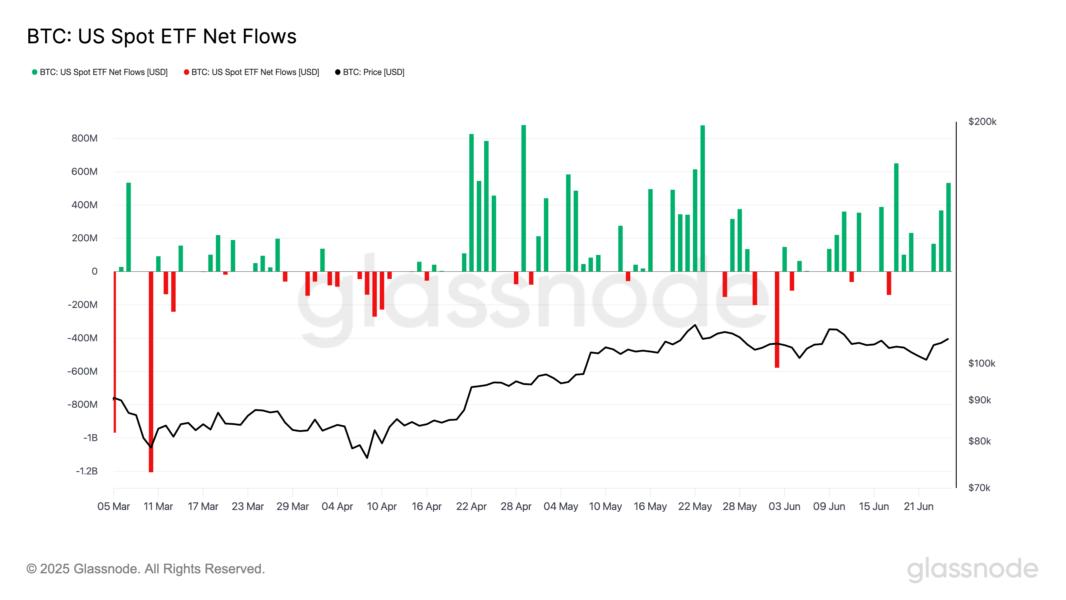

Wall Street investors have poured over $1 billion into spot Bitcoin ETFs this week, coinciding with the US dollar’s persistent decline.

Trump’s Fed shocker coincides with >$500 million Bitcoin ETF inflows

As of June 25, these ETFs held 1.234 million BTC, up by more than 9,722 BTC over the past three days, according to Glassnode data. That amounts to roughly $1.04 billion in net inflows so far this week.

More than half of this week’s inflows came on June 25, following a Wall Street Journal report that Donald Trump may announce a replacement for Fed Chair Jerome Powell as early as September.

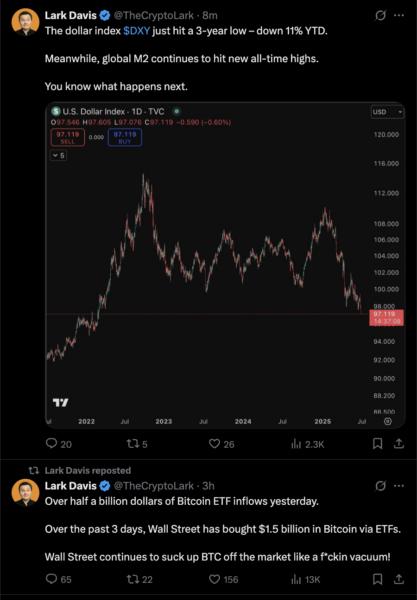

The US Dollar Index (DXY), which tracks the greenback’s strength against a basket of foreign currencies, fell 1.23% since the WSJ report, hitting its lowest level since April 2022.

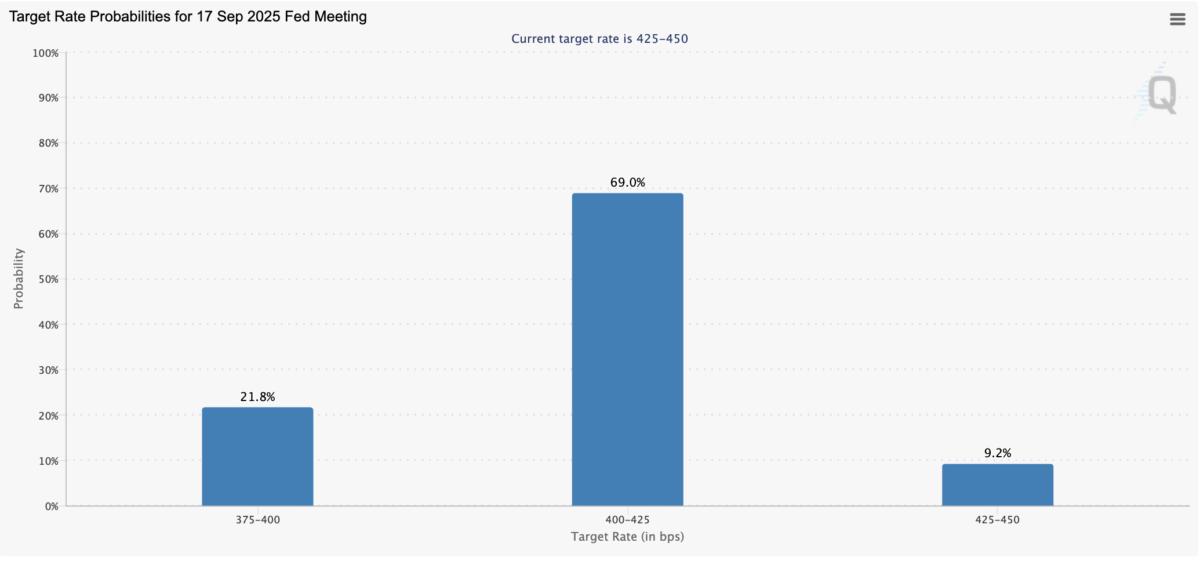

The dollar’s decline comes as traders increase bets on Federal Reserve rate cuts later in September, with the odds of a 25 basis point reduction rising to 69% from 47.70% a month ago.

Lower rates have historically dampened the appetite for the dollar, while increasing demand for non-yielding assets, such as stocks and cryptocurrencies.

BTC’s price has risen by over 2% to around $108,360 since the WSJ report, with ETF inflows further suggesting a growing risk appetite among retail traders and institutional investors.

Dollar’s “do-or-die” scenario is bullish for Bitcoin

The dollar is looking at a “do-or-die” scenario in July, according to NorthmanTrader Founder Sven Henrich, referring to a chart showing DXY testing a critical support confluence near 97.50.

The confluence comprises the lower trendline of a multiyear ascending channel, the lower trendline of a multimonth descending channel, and a horizontal support.

“Break below ~97.5, and the next level of structural support may not come in until the low 90s,” commented analysts at Linq Energy on Henrich’s outlook, adding:

“If the dollar cracks, expect serious implications for commodities, gold, and EM flows. July could set the tone for 2H macro.”

The dollar’s outlook, combined with with an increase M2 supply, could prompt Wall Street investors “to suck up BTC off the market like a f***ing vacuum,” notes analyst Lark Davis in a series of X posts.

Multiple chartists see Bitcoin hitting the $150,000 mark and even higher by the end of 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

Cointelegraph

Jul 19, 2025 08:07:11

Coinpedia

Jul 19, 2025 07:18:43

CryptoPotato

Jul 19, 2025 07:15:12

Cointelegraph

Jul 19, 2025 07:11:20

Cointelegraph

Jul 19, 2025 07:11:20